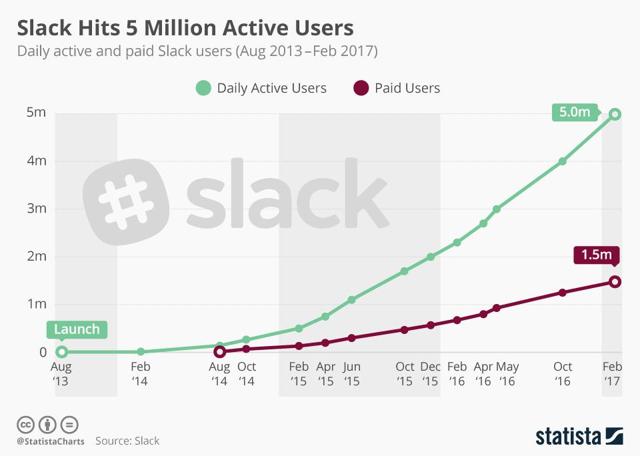

Their markets (and especially Slack's) face significant competition, especially from Microsoft's Teams products. The companies are in adjacent verticals, and are not really direct competitors. That said, there doesn't appear to be any real antitrust reason to block the deal. That re-starts the clock on the Department of Justice's deadline to approve or sue to block the deal, resetting it to 30 days from the time their questions are answered. The parties did receive a second request from information from the Department of Justice. The biggest risk here seems to be antitrust scrutiny of the deal. The risk of the deal not closing is always an item for investor judgement in any merger arbitrage situation. Salesforce shares are easy to borrow for investors who wish to lock in the spread. The deal is large and both constituents are liquid. A close on that date would be a 16.7% internal rate of return, which is satisfactory. That is an equity-like return, especially considering the companies are still planning to close by July 31, 2021. With Slack shares at $40.70, that is a spread of 6.0%.

In this case, with CRM at $210.80 which puts the value of the offer at $43.15 after accounting for both the cash and share components of the consideration. The easiest to determine is always the spread, as it can be calculated directly. The decision to invest in any specific merger arbitrage opportunity is largely based on three factors: the spread, the risk of the deal not closing, and the likely price response to the deal not closing. Should you play the merger arbitrage between Slack and CRM? The significant cash portion of the bid provides quite a bit of assured value to Slack shareholders, while the share portion of the consideration does allow them to benefit from any further upside from synergies related to the transaction.

The agreement stipulates that Slack shareholders will receive $26.79 in cash and 0.0776 Salesforce shares per share of WORK owned. Slack Technologies ( NYSE: WORK), the collaboration software firm, is the subject of a takeover bid from Salesforce ( NYSE: CRM).

0 kommentar(er)

0 kommentar(er)